Do You Know Where Your Sensitive Data Is?

ERP and SAP systems are vast with terabytes of data and thousands of tables and transactions with various levels of user access. This includes sensitive data that is subject to compliance regulations. A high degree of fragmentation makes it difficult to track down every piece of sensitive data leaving you vulnerable to compliance risks. ComplyD solves this challenge by locating all sensitive data for your organization.

Is Your Sensitive Data Safe & Compliant?

Most organizations are unsure if any critical data is left unprotected and whether all the gaps are covered. Constantly evolving compliance requirements that vary across industries and countries necessitate protection of such data as per regulatory requirements. While SAP uses a role-based protection approach, ComplyD works with SAP and other systems to provide a higher degree of control with comprehensive visibility. This enables greater data level protection and facilitates data compliance.

Unified Dashboard & Analytics

Custom Parameters, Rulebook & KPIs

for Data Protection Strategy

Flexible Implementation with

Customization

Unified Solution for Data Privacy & Compliance

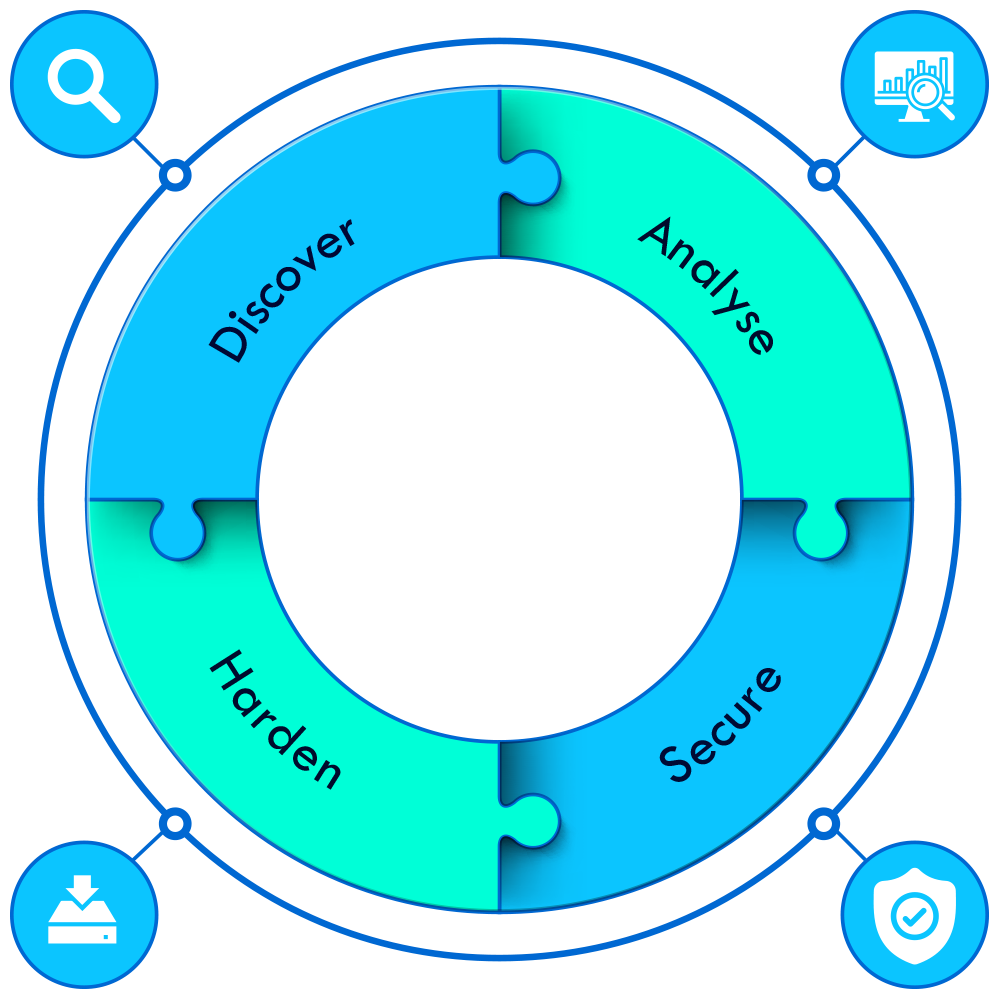

DASH Approach

What if you could count on an eagle-eye watch that automatically provides comprehensive visibility of all your data so you can take action to ensure compliance? ComplyD does exactly that with a single powerful dashboard. Harness powerful automation that proactively discovers any vulnerabilities regarding sensitive data based on a customized rule book, analyzes relevant measures to seal the discovered gaps, secures data by expanding your security perimeter and hardens entry points sealing them against potential attacks.

Empowering Organizations to Stay Compliant

ComplyD enables organizations to meet any data compliance requirements that vary across industries and geographies, based on the comprehensive visibility that allows them to take the necessary steps protect their data. Reduce the risk of penalties and minimize the level of effort required to produce compliance reports. Leverage enhanced abilities to clearly demonstrate measures taken to protect data.

The General Data Protection Regulation (GDPR) pertains to regulating the collection and processing of any EU personal data. This applies to any business anywhere in the world that handles such data. It necessitates protecting the rights of EU people through transparent collection and processing of data, correction and deletion of personal data and the ability to access collected data. In case personal data is being transferred outside the EU there are several GDPR requirements that must be adhered to. Any violations can lead to the greater amount – fines of up to 4% of the offending entity’s gross revenue or €20M.

The California Consumer Privacy Act (CCPA) provides a wide umbrella of protection for California residents personal information. This includes rights to be informed of business privacy practices, to access and delete personal information, and to bar any third-party use of their personal information. Violations can be punished by fines up to $7,500 per record and there is also the possibility of a class-action litigation on behalf of a group of individuals.

The Health Insurance Portability and Accountability Act (HIPAA) dates back to 1996. It protects the protected health information (PHI) of patients. A subsequent law, the Health Information Technology for Economic and Clinical Health Act (HITECH) was enacted in 2009. It essentially extends HIPAA requirements to other businesses that associate with healthcare providers providing a wider range of PHI protection. The Confidentiality of Medical Information Act (CMIA) is the state of California’s extension of HIPAA to any individually identifiable medical information employers hold. There are 4 tiers of assessment for HIPAA penalties. They range from $100 to $1.5 million per violation per year.

The Payment Card Industry Data Security Standard (PCI DSS) is an information security standard required by credit card brands. It must be followed by any type of organization that processes payment from cards. Failing to protect such data can lead to fines up to $500,000 per incident in addition to the possibility of losing the capability to process any more payments, effectively freezing operations.

Any other compliance standard can be adhered to as companies can take the requisite action for data protection based on the comprehensive visibility and data protection abilities provided by ComplyD.